Sometimes companies require employees to work on holidays and this holiday time like any other type of working hours should be fairly compensated. The type of pay that companies give employees working on holidays is known as holiday premium pay.

In this article, we dwell on the topic of holiday premium pay: how to calculate it, how to document it in the company policy, and how to automate these calculations effectively.

What Is Holiday Premium Pay?

Holiday pay refers to the amount of pay that an employee is entitled to during a period of time when they are not working, such as a public holiday, Christmas break, or annual leave. This pay is usually calculated based on the employee’s normal working hours and rate of pay.

On the other hand, holiday premium pay (also known as “double time”) refers to the extra pay for employees who agree to work on a holiday.

Holiday premium pay = (2 x basic pay rate) x worked holiday hours

Holiday premium pay is called “double time” because holiday premium pay usually equals double the basic pay. However, depending on local regulations (or the lack thereof), companies can set their own holiday pay rates, which must not be less than the employee’s regular rate.

Holiday Premium Pay in the United States

Federal US employees are entitled to a minimum of 2 hours of holiday premium pay. Beyond that, additional regulations are applied according to the type of work schedules:

- Federal employees with a standard work schedule are eligible for holiday premium pay “if they are required to work on a holiday during their regularly scheduled non-overtime basic tours of duty, not to exceed 8 hours” (source).

- Federal employees with flexible schedules are eligible for up to 8 hours of holiday premium pay.

- Compressed schedule employees get up to 9 or 10 hours of holiday premium pay, according to their work schedule.

As for employees in the US private sector, there are currently no regulations requiring employers to provide them with either regular or premium holiday pay.

Paid Holidays in the United States

Federal workers in the United States enjoy statutory paid holidays on the following occasions:

- New Year’s Day (January 1)

- Martin Luther King Jr. Day (Third Monday of January)

- Presidents’ Day (Third Monday of February)

- Memorial Day (Last Monday of May)

- Independence Day (July 4)

- Labor Day (First Monday of September)

- Columbus Day (Second Monday of October)

- Veterans Day (November 11)

- Thanksgiving Day (Fourth Thursday of November)

- Christmas Day (December 25)

While private-sector employees in the US are not entitled to have paid holidays by law, some companies do offer paid holidays as part of their benefits package.

According to the Bureau of Labor Statistics, as of March 2022, only 81% of all private industry workers had access to paid holidays, whereas only 46% of workers with the lowest wages had access to them. This means that nearly a quarter of workers in the US don’t get paid time off for holidays like Christmas, Independence Day, or Thanksgiving, and the lower your income is the more disadvantaged you tend to be in terms of time off benefits.

Holiday Premium Pay vs. Overtime Pay

Holiday premium pay and overtime are often confused as they both refer to time worked beyond normal working hours. Let’s see what’s the difference between them.

Overtime refers to the extra time worked by employees after their regular hours. In most countries, overtime regulations are not applied to holidays and Sundays, if these are not considered working days according to the employee’s schedule.

Let’s say, an employee has worked 45 hours for the week by putting in an extra hour from Monday to Friday. Their monthly overtime will include these 5 extra hours and their overtime pay will be calculated according to their overtime rate.

Holiday premium pay is pay for non-overtime hours of work that an employee is required to work on a holiday.

For example, an employee has worked for 40 regular hours and 8 hours on holiday. Their worked holiday hours are not considered overtime. Instead, this employee will be paid 2 times the regular wages: one is their basic pay and the other is holiday premium pay, which equals their basic pay.

Here’s a comparison table that will help you get the difference.

How to Calculate Holiday Pay?

Example 1: Hourly employee (without premium holiday pay)

Let's suppose you have an employee who works 40 hours a week, earning $15 per hour. They are entitled to two weeks of paid vacation per year. Several public holidays come as part of their vacation entitlement and are paid at the employee's regular rate.

To calculate their holiday pay for Christmas, you would take their hourly rate ($15) and multiply it by the number of hours they would have worked during the holiday (8 hours). So, their pay for the Christmas day would be $120 ($15 x 8 hours).

Example 2: Salaried employee (with premium holiday pay)

You have a salaried employee who earns $50,000 per year and is entitled to 1.5x premium holiday pay.

To calculate their pay for work on a public holiday, you would divide their annual salary by the number of working days in a year (260 days) to get their daily rate ($50,000 / 260 days = $192.31 per day). Then, you would multiply their daily rate by the number of holidays they've spent working (1 day). So, their holiday pay would be $288.46 ($192.31 x 1.5).

Example 3: Hourly employee (with overtime + premium holiday pay)

Let’s say, an employee has worked 45 hours for the week: 40 regular hours, 1 overtime hour, and 4 hours on holiday. Their regular rate is $6 per hour, the overtime rate is $9 per hour (1.5 x 6), and the holiday premium pay rate is double their regular rate. In this case, their weekly compensation is calculated in the following manner:

- 40 hours of regular work = $6 x 40 = $240

- 1 overtime hour = $6 x 1.5 = $9

- 4 hours of work on a holiday = $6 x 2 x 4 = $48

- Total weekly income = $297

Pro tip:

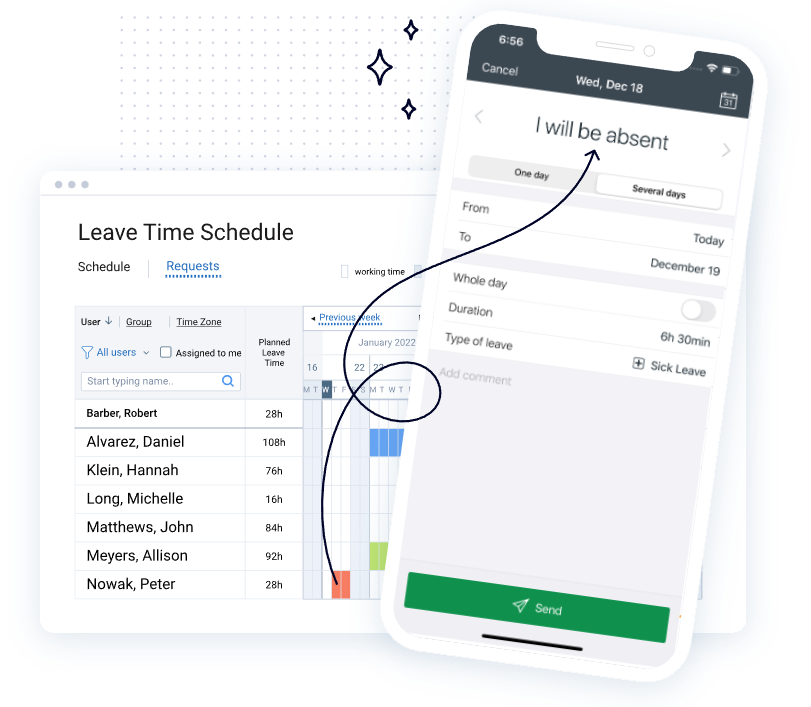

Use actiPLANS to track employees' leave and automate time off calculations to ensure no errors are made. The solution comes equipped with a built-in visual timeline that displays employees' leave requests and work schedules, so you can quickly and easily see who's out of the office and when.

It also features flexible time off management settings, allowing you to choose how to accrue employees' leave time. Besides, you can integrate your actiPLANS account with actiTIME to set custom pay rates for employees' regular, overtime, and leave hours and then track payroll-related costs in a 100% streamlined way.

How to Build a Holiday Premium Pay Policy?

To manage holiday premium pay effectively, HR professionals need to create a comprehensive policy, which addresses the following key points:

- Is holiday time off paid? If it is, then which holidays are covered?

- Is holiday premium pay paid out or converted to time off in lieu?

- How is holiday premium pay calculated?

- Who is eligible for holiday premium pay?

- Who is not eligible for holiday premium pay?

- How many holiday premium pay hours are allotted for full-time and part-time employees?

- How are holidays falling on the weekend administered?

- If an employee has already applied for leave on a holiday, which rules will be applied in this case?

One of the greatest approaches to holiday premium pay policy is to document the eligibility and administration for all employee groups, including exempt, nonexempt, full-time, and part-time employees. Update employee handbooks so that they can look up the company’s holiday premium pay policy anytime.

How to Stay Compliant with Holiday Pay Regulations

If an employer fails to pay holiday pay correctly, they could be subject to legal action from the employee. This could result in financial penalties, as well as damage to the employer's reputation.

To ensure that you're compliant with holiday pay regulations, you should keep accurate records of employee working hours, rates of pay, and holiday entitlement. You should also regularly review your policies and procedures to ensure that they are up to date with any changes in the law.

To track employees' working hours and keep a record of time off balances, consider using work management software with a time tracking module. For example, actiPLANS – work and leave management system with a native actiTIME integration for time tracking and project management.

With actiTIME, you can:

- Automate payroll calculations by setting up custom work time and overtime policies in the system that follow federal laws and meet internal payment policies.

- Manage projects, distribute work, and help your team get work done on time and budget by setting task estimates and deadlines.

- Capture working time in various ways from different devices, review, approve, and store employee timesheets to meet state laws and regulations.

Track time in actiTIME by entering task duration or logging the start and end times of tasks using an online timesheet or the calendar view

With actiPLANS, you can schedule work, including work on holidays, to plan and accurately track holiday premium pay for your employees. Its leave management interface allows you to manage employee leave requests, review team availability, manage leave balances, and convert it to time off in lieu.

Work scheduling in actiPLANS – create custom work types, assign them across your team taking their time off into account, and review project activities on a timeline

actiPLANS provides a free plan for individuals and teams of up to 3 users. It is scalable, integrated with actiTIME, and can be upgraded as your team grows.

Try actiPLANS for free with a free 30-day trial (no credit card required).