When an employee leaves a company, whether voluntarily or involuntarily, one of the many considerations is how their accrued Paid Time Off (PTO) will be handled.

Exit PTO payouts can be a significant aspect of this process, and understanding what they are, how they are calculated, and who is entitled to them is crucial for both employees and employers. This blog post delves into the key aspects of exit PTO payouts, providing necessary guidance and describing best practices.

What Are Exit PTO Payouts?

Exit PTO payouts refer to the compensation an employee receives for any unused PTO at the time of their departure from a company. This includes vacation days, personal days, and sometimes sick leave, depending on the employer’s policy.

The payout is generally made in the employee’s final paycheck and can provide a financial cushion for those transitioning to new employment.

Who Is Entitled to Exit PTO Payouts?

Generally, employees who resign or are laid off are entitled to their accrued PTO, while those terminated for cause may not be. However, entitlement to exit PTO payouts varies by company policy and state law.

Some companies, for example, may offer a full payout of unused PTO, while others may have a “use it or lose it” policy where unused days are forfeited upon termination.

Different countries and states also have varying regulations regarding PTO payout.

In some US states, employers are required to pay out all accrued PTO upon termination, while in others, it may not be mandated.

For example, California law requires that all accrued vacation pay be paid out upon termination, while other states may not have such requirements.

How Are Exit PTO Payouts Calculated?

Calculating exit PTO payout is quite simple.

First of all, you know how much PTO you have accrued. These include any vacation days, personal days, and potentially sick leave that your company allows to be carried over.

Next, review your company’s policy on how PTO is accrued and whether any limits apply. For example, some companies may cap the number of vacation days that can be accrued.

The value of the unused PTO is usually calculated based on the employee’s regular hourly rate or salary.

Example: If an employee has 40 hours of unused vacation time and their hourly rate is $25, the payout would be:

Remember that exit PTO payouts are subject to taxes just like regular income. So, the amount you receive will be reduced by federal and state taxes.

Exit PTO Payout Best Practices for Employers and Employees

Managing exit PTO payouts requires careful attention to both legal and financial considerations.

Common issues that arise include:

- Errors in calculation. Manual calculations of PTO accrual and payout can lead to errors, especially when employees have irregular work schedules or intermittent absences.

- Inconsistent payouts. Different employees with similar PTO balances may receive varying payouts due to variations in how managers approve time-off requests.

- Lack of transparency. Employees may not clearly understand how their PTO is tracked and paid, leading to confusion and dissatisfaction.

Employers and employees can ensure a smooth and compliant transition process by following the tips below.

Employer’s Perspective

- Establish a clear policy regarding PTO payout upon employee departure, including any exceptions or limitations. Communicate the policy clearly to employees during onboarding and throughout their employment.

Check out our quick guide on Creating a PTO Policy in 5 Steps.Accurately track employee PTO accrual and balances to calculate the appropriate payout.

- Implement a robust system to track employee PTO accrual and balances accurately.

- Utilize attendance-tracking software or payroll systems to automate this process.

- Regularly review and reconcile PTO records for accuracy.

Automated leave management software like actiPLANS offers a solution to streamline this process and ensure accurate and timely PTO payouts upon employee departures.

The tool automatically calculates PTO based on the custom employee schedules and predefined rules, ensuring fairness and consistency for all employees.

3. For employees who depart before accruing enough PTO for total payout, prorate the payout based on the number of days worked during the company tenure.

Divide the employee’s total PTO balance by the number of workdays in the calendar year or the equivalent contractual period. Then multiply the prorated balance by the number of days worked to determine the payout amount.

Use the free actiPLANS PTO calculator to ensure the accuracy of your calculations.

4. Consult with legal counsel to ensure compliance with local labor laws and regulations regarding PTO payout.

- Review relevant state or federal statutes to avoid potential legal issues.

- Conduct periodic audits to ensure adherence to the established policy and compliance with legal requirements.

- Train HR staff on the PTO payout process to ensure fairness and accuracy.

Provide written documentation of the PTO payout, including the amount paid and payment date.

5.Provide written documentation of the PTO payout, including the amount paid, the date of payment, and the remaining PTO balance (if any).

Secure employee acknowledgment and signature on the documentation to maintain transparency and prevent disputes.

Employee’s Perspective

- As soon as you give notice of your departure, reach out to your employer to initiate the PTO payout process, giving them ample time to calculate and issue the payment before your last day.

- Refer to your PTO tracking system to avoid discrepancies in the payout calculation.

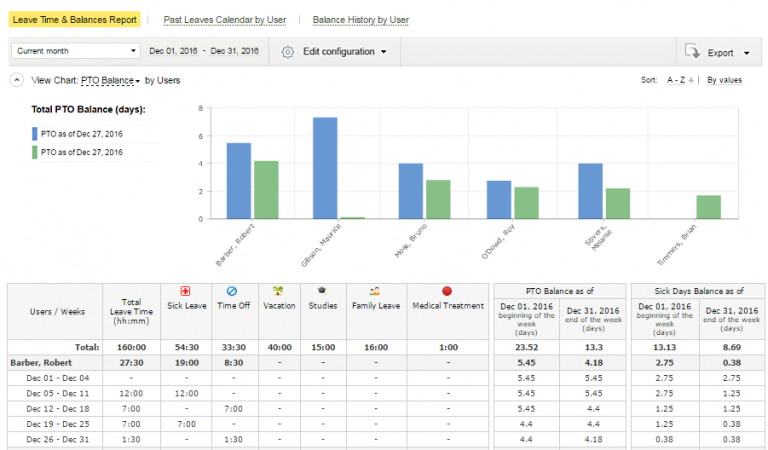

For example, actiPLANS offers the Leave Time & Balances Report that allows you to summarize time off and leave balance data.

It can be generated as a chart or table and exported as a CSV or PDF file.

- Once you receive the PTO payout calculation, carefully review it for accuracy. Ensure that the number of accrued PTO hours and the hourly rate used are correct. Any errors can result in discrepancies in the payout amount.

- Consult with a payroll specialist or tax accountant to determine how the payout will impact your taxes. You may need to allocate a portion of the funds for tax payments.

- If your PTO payout exceeds a certain threshold set by the tax authorities (e.g., $600 for the IRS), you must report it to them. Consult with a tax professional for specific guidance on your jurisdiction’s applicable threshold and reporting requirements.

- Retain a copy of your PTO payout calculation and any correspondence with your employer regarding the payout.

- If you are still waiting to receive your PTO payout within a reasonable timeframe, follow up with your employer to inquire about the status.

In the event of a dispute regarding an exit PTO payout, employers and employees should attempt to resolve the issue amicably. They can consider mediation or arbitration to reach a mutually acceptable solution.

Conclusion

Exit PTO payouts can be a time-consuming and error-prone process, especially if you have a large number of employees. By implementing a streamlined approach and a dedicated tool you can simplify this task and ensure accurate and timely payments.

So, maybe it’s time to give actiPLANS a try! Grab your free 30-day trial, try all the tool’s features, and decide later whether to continue or not.