Struggling to wrap your head around paid time off (PTO) payouts and the tangled web of taxes that comes with it? This guide is designed just for you – packed with expert insights and practical tips to make the nitty-gritty of PTO less of a headache.

We’ve got the scoop to keep you confident and informed as you’re navigating payout policies and relevant tax regulations.

Let’s dive in and make PTO payout management a breeze!

What Is PTO Payout?

PTO payout is when you compensate employees for the unused vacation or sick days they’ve accumulated but haven’t taken.

For example, an employee has been hustling all year, and by the end of it, they’ve still got a chunk of leave days left. Rather than let those days disappear into the ether, PTO payout ensures that the employee gets paid for them instead (even if they’ve decided to quit their job).

It’s like a little financial bonus for hard work and dedication, a reward that acknowledges that the employee didn’t take those deserved breaks but still showed up and got the job done.

When Can Employees Get PTO Payouts?

The answer to the above question can vary depending on a company’s policy. Here are 3 typical scenarios where employees might find themselves eligible for PTO payouts:

- Upon termination: Whether an employee is leaving on their own terms or being let go, you have an option to cash out their remaining PTO. In some cases, PTO payouts upon termination are required by the law, depending on the state where you run your business. In either case, it’s like a little farewell gift and an extra measure to guarantee your professional relationships end on good terms.

- Upon retirement: After dedicating countless years to their job, retirement can be an exciting transition for employees. And as an employer, you can reward this milestone with a PTO payout. It’s a nice financial cushion as the employee steps into the golden years and plan their next adventures.

- At the end of the year: In case you offer a flexible PTO policy, you might let your team members cash out unused PTO at the end of the year. It’s like a little holiday bonus for all the hard work they’ve put in over the months. From employees’ perspective, this can be a great way to get some extra funds just in time for year-end festivities or even a well-deserved vacation at the beginning of the next year.

PTO Payout vs. Use-It-Or-Lost-It PTO Policy

Payouts are just one method to handle employees’ accrued PTO. Another one is the use-it-or-lose-it policy.

This policy is exactly what it sounds like: employees must use their PTO within a certain period (usually within a year), or they lose it. In other words, it doesn’t allow for PTO to roll over into the next year or get cashed out if unused.

As compared to PTO payouts, the use-it-or-lose-it policy has the following pros and cons:

Pros:

- Encourages time off: This policy often nudges employees to actually take breaks throughout the year. Taking time off can prevent burnout and increase overall productivity.

- Simplifies planning: From an administrative perspective, this policy is a lot easier to manage – HR doesn’t have to track carryover days or calculate PTO payouts.

- Cost predictability: Companies can better predict their annual leave liabilities, avoiding potential large payout costs at the end of the year or when an employee leaves.

Cons:

- Risk of lost benefits: Employees can feel shortchanged if they end up losing vacation days due to work demands or personal choice.

- End-of-year rush: There’s often a last-minute scramble in December as employees rush to use up their PTO, which can disrupt workflow and productivity.

- Lower employee morale: Some employees might view this policy as restrictive, feeling pressured to take time off even when it’s not convenient for them.

Summary:

In contrast to the use-it-or-lose-it-policy, PTO payouts offer employees more flexibility in taking time off or cashing out. However, that means your company will face unpredictable and sometimes hefty payout obligations. Besides, payouts can create complexities, including higher administrative costs and increased liability on the balance sheets.

In the end, your goal here is to balance your company goals with employee satisfaction. So, no matter which policy you decide to implement – stay tuned to employee feedback and remain adaptable to changes.

US Federal Laws Regarding PTO Payout

Fair Labor Standards Act (FLSA)

The FLSA sets the ground rules for minimum wage, overtime, and more, but it doesn’t specifically require employers to offer PTO or payout for unused PTO. This means it leaves room for state laws and company policies to fill in the gaps.

PTO as a Wage

According to the Department of Labor, if an employer promises PTO as part of an employee’s wages, then it must be treated like any other earned wage. This means that, depending on state laws, an employer might be required to pay out unused PTO when an employee leaves the company.

State Regulations

The federal government gives a broad framework regarding the management of PTO payouts, so the specifics really come down to the state laws and individual company policies.

Here are the US states where PTO payouts upon termination are a must:

California

California is pretty generous when it comes to PTO payouts. If you leave a job, whether voluntarily or involuntarily, your employer must pay out any accrued vacation time. It’s considered earned wages in the Golden State and has no expiration date, so no leaving money on the table here!

Colorado

In Colorado, employers must pay out any earned and unused vacation time upon termination. The term “earned” is key here, meaning if you’ve accrued it, you’re entitled to it. The state also frowns upon any agreements that suggest otherwise – so employees are pretty well protected.

Illinois

Illinois is right there with Colorado and California. When you part ways with your employer, they must pay out your accrued vacation days. The Land of Lincoln doesn’t mess around with your hard-earned PTO.

Indiana

Indiana is a bit different. While there’s no state law that specifically requires PTO payouts (or paid vacation as such), the practice can be enforced based on company policy. If your company handbook states you’ll get paid out for unused PTO, then it’s binding. So, it’s a good idea for employees to know their company’s policies.

Maine

In Maine, employers with more than 11 employees are required to pay out accrued vacation time starting January 1, 2023. Thus, no matter which particular policy your company has, employees have the right to cash out their unused accrued vacation days.

Maryland

Maryland goes by the employer’s written policy. If the policy states that employees will be paid for unused vacation time upon termination, then that rule must be followed. So, Marylanders, make sure to keep an eye on your company’s handbook.

Massachusetts

In Massachusetts, it all depends on corporate policies. If the company offers paid vacation to employees, it is considered wages. In that case, employers must pay out unused days off when employees leave the job, no questions asked.

Rhode Island

In Rhode Island, the rules also largely depend on an employer’s written policy or agreement. If the company offers paid vacation time to employees, it should be paid out upon termination in case an employee works in that company for at least one year.

West Virginia

West Virginia’s approach is somewhat employer-specific, similar to Maryland. If a company policy or contract stipulates that unused PTO will be paid out and when, then these rules must be honored. Otherwise, there’s no state mandate requiring it.

Wyoming

In Wyoming, the rules are employer-driven. There’s no state law mandating the payout of accrued PTO unless it’s outlined in the employment contract or company policy.

How to Calculate PTO Payouts

Depending on whether you have hourly or salaried employees, the formulae to determine their PTO payouts have a few key differences. Let’s get into them below:

For hourly employees

For hourly employees, the process begins with determining their regular hourly rate. From there, you need to multiply this rate by the total number of accrued but unused PTO hours.

Example:

Suppose an employee earns $20 per hour and has accrued 50 hours of PTO. Here’s the math:

So, the employee would receive a PTO payout of $1000.

For salaried employees

For salaried employees, you’ll need to figure out their hourly rate first by dividing their annual salary by the total number of work hours in a year. Once you have your hourly rate, you multiply it by the number of accrued but unused PTO hours.

Example:

Let’s say an employee has an annual salary of $52,000. Typically, a full-time employee works about 2080 hours per year (40 hours a week for 52 weeks). If they’ve accrued 80 hours of PTO, the math would be as follows:

- Calculate your hourly rate:

- Compute your PTO payout:

So, you’d be looking at a PTO payout of $2000.

How Is PTO Payout Taxed?

PTO is essentially part of your earnings in many US states, just like your regular paycheck. Thus, when you get a payout for unused PTO, the IRS treats it as supplemental income. This means it’s subject to federal income tax, Social Security, and Medicare taxes.

Let’s say your employee has $1,000 worth of unused PTO. When paying this out, you’ll withhold taxes just as you do with your regular wages. For instance, if the employee is in the 22% federal tax bracket, you’ll withhold $220 for federal income tax. Of course, the exact amount can vary based on deductions, state taxes, and other factors.

For example:

Jane Doe lives in California and is in the 22% federal tax bracket. If she receives a $2,000 PTO payout, she’ll see the following deductions:

- $440 for federal income tax

- About $153 for Social Security (since it’s 6.2% of the payout)

- Roughly $29 for Medicare (at 1.45%)

- California’s state income tax, which varies depending on her exact situation

Automate PTO Accrual with actiPLANS

PTO accrual and tracking can be a real hassle if you’re stuck doing it manually. One missed day or a single error can throw off all your records.

That’s where actiPLANS comes in, making your life a whole lot easier thanks to handy automation. It keeps everything accurate and up-to-date, so you don’t have to worry about discrepancies or the fallout from human error.

Here’s how actiPLANS helps:

- Real-time PTO accrual calculations: Every time an employee earns PTO hours, actiPLANS automatically updates their balance in line with the rules you set in advance. Employees can see exactly how much PTO they’ve accumulated without bugging HR. So, say goodbye to those endless email requests asking how much vacation time someone has left. This not only saves time but boosts team satisfaction because everyone can plan their time off better.

- Automated approval workflow. Employees can submit their time off requests using an intuitive visual timeline or a mobile app, and managers get instant notifications to approve or reject them. This swift approval process ensures that requests don’t get lost in the shuffle (take, for example, last-minute holiday requests that need immediate attention). With actiPLANS, managers can see all pending requests in one place and make quick, informed decisions. Plus, you have an option to automate the approval process entirely or just for specific leave types.

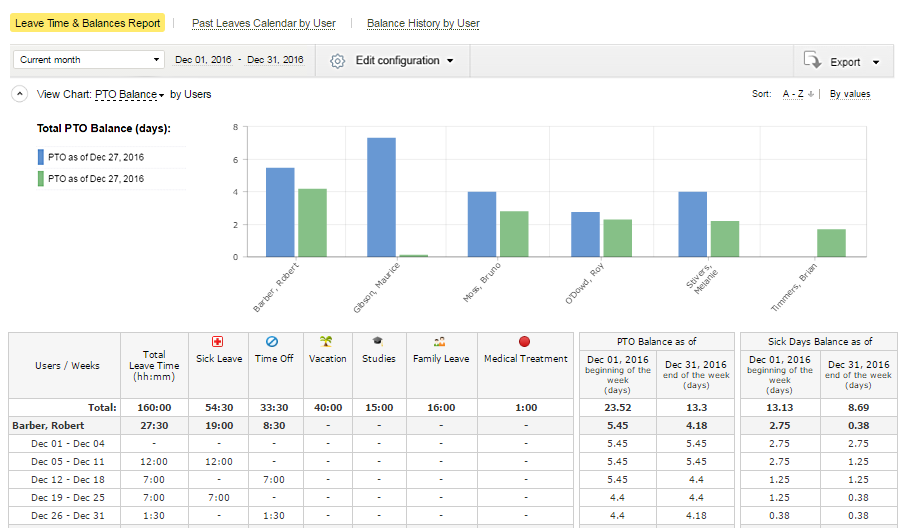

- Detailed reporting. You can generate comprehensive reports on PTO usage, trends, and balances. This is especially helpful during budgeting or when analyzing your team’s workloads and capacity. For instance, if you notice a trend where employees in a certain department rarely take time off, it might be a flag for potential burnout.

To sum it up, actiPLANS simplifies the entire PTO management process, cuts down on administrative tasks, and leaves everyone more satisfied. You get accuracy, efficiency, and insightful data – all wrapped up in one neat package.

Sign up for a free 30-day trial – you’ll wonder why you haven’t done it earlier.