Leave liability represents the value of any paid time off that your employees have earned but haven’t used. This includes vacation days, personal days, or any other type of leave that your team can cash in on.

If you don’t keep track of it, you could end up in a tricky situation both in terms of workforce availability and finance. Just imagine one of these scenarios:

A long-serving employee leaves the company or retires with quite a few vacation days still on the books. As a result, you’re hit with a significant payout that you didn’t see coming.

Several employees decide to take long vacations at the same time. Now, you’re either shelling out for temporary staff or paying overtime to others to fill in.

And there’s more to it: for investors, it might look like you’re not in good shape financially because those vacation hours are counted as debt on your balance.

So, the best strategy is to keep your leave liability down and under control. Let’s see how to do it!

Keep a Close Eye on Leave Accrual

As employees accrue leave, the company’s liability grows, so the first step to managing it is being able to calculate it correctly.

To do so, you should know the total amount of leave each employee has earned. This amount is multiplied by this employee’s hourly wage or salary equivalent. Next, individual liabilities are summed up to get the total leave liability for the organization.

Let’s say you have three employees with the following details:

Employee A:

- Hourly wage: $25

- Accrued eave: 40 hours

Employee B:

- Hourly wage: $30

- Accrued leave: 30 hours

Employee C:

- Hourly wage: $20

- Accrued leave: 50 hours

Step 1: Calculate individual leave liabilities

Employee A:

Employee B:

Employee C:

Step 2: Sum up leave liabilities

Pitfall to avoid: Inaccuracies

Since leave liabilities are determined by the amount of unused paid time off employees have accrued, their accuracy relies heavily on the underlying data. Therefore, ensuring this data is precise is crucial

Besides that, businesses apply different accrual rules, so the number that was correct a week ago can be very different today.

How actiPLANS helps:

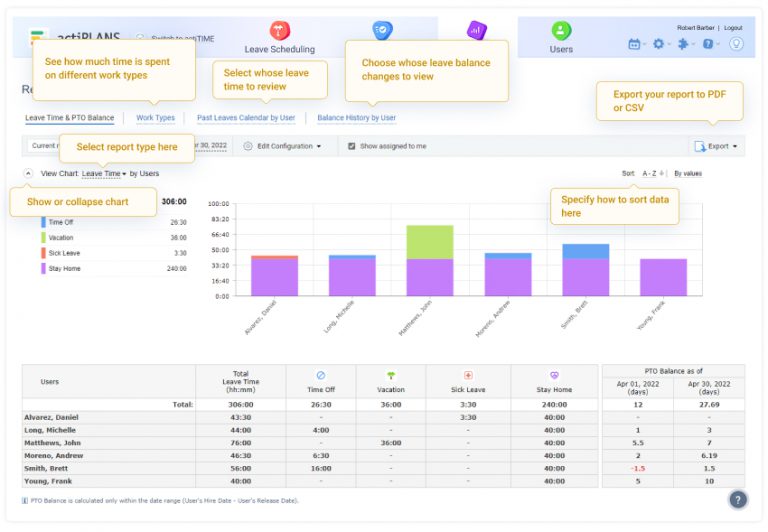

The Leave Time and Balances Report provides insights into how much leave each employee has accrued.

When generating this report, you can sort the data by Leave Time, PTO Balance, or Sick Days Balance to exclude the types of leave that are not part of your liability from the calculation.

With this visibility, you can take proactive measures before liabilities escalate into an issue.

Encourage PTO Planning

Encouraging employees to plan their PTO in advance allows them to take necessary breaks, recharge, and return to work rejuvenated.

This enhances individual productivity and lets you avoid unexpected large payouts caused by the accumulation of unused leave days.

Moreover, when employees plan their time off in advance, you can prepare for absences and ensure that workloads are balanced and projects remain on track.

To learn more about effective PTO planning, refer to this blog post.

Pitfall to avoid: Scheduling conflicts

Though PTO planning is intended to prevent scheduling conflicts, sometimes it works vice versa. Everybody wants to go on holiday for Christmas, you know… So, be prepared to offer alternatives or find some backup options.

How actiPLANS helps:

actiPLANS offers the Past Leave Calendar and PTO and Sick Days Balance History, allowing you to analyze historical data, identify peak vacation periods, and plan accordingly.

It also lets team members view each other’s schedules and planned vacations and minimize disruptions while maintaining work-life balance.

Review Your Policy

Another way to reduce leave liability is by putting a limit on how much paid PTO employees can roll over into the next year or even introducing the “use-it-or-lose-it” policy.

For instance, you could let employees carry over up to 10 days, but anything beyond that would be lost.

Pitfall to avoid: Failing to comply with local laws

Depending on where your business operates, there may be laws regarding how you handle leave liabilities. For example, in some US states, unused vacation days must be paid out at the end of the fiscal year.

Not complying with these regulations can lead to legal troubles and fines—definitely not something you want to deal with!

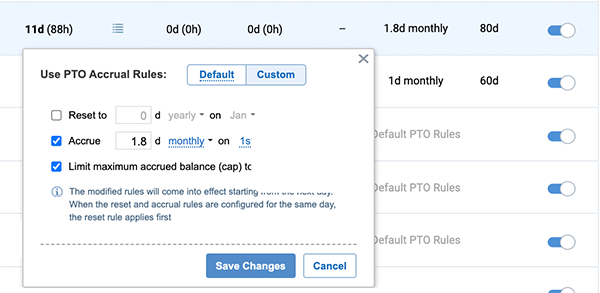

How actiPLANS helps:

You can create custom leave policies for offices, teams, and even specific employees, defining accrual rules, accrual caps, and reset rules.

Plan for Payouts

If you know that certain employees are likely to leave soon or retire, plan ahead for those potential payouts in your budget.

You can also consider allocating a specific amount of money each month or year into a reserve fund designated for future PTO payouts.

You can also check the leave balances of the resigning employees and offer them the opportunity to use their PTO fully or partly before departure.

Pitfall to avoid: No quick access to data

Any proactive approach only works when you don’t need to track or analyze data manually, digging into emails and spreadsheets.

How actiPLANS helps:

The tool automatically monitors the PTO accrued and utilized by each employee.

Additionally, it allows employees and managers to view leave balances, request time off, approve requests, and have the system update balances in real time.

Final Thoughts

Leave liabilities may begin as a minor headache, but if neglected, they can escalate into significant financial and operational challenges.

actiPLANS allows you to automate and streamline all facets of scheduling, forecasting, and tracking employee time off, enabling you to maintain accurate records, enforce policies uniformly, and manage leave liabilities hands down.